بسم الله الرحمن الرحيم

06 Ramadan 1446/07 March 2025

All praise is due to Allah, the Cherisher, Sustainer, Nourisher and Provider of the entire creation. May peace, blessings and salutations be upon our Beloved Prophet Muhammed ﷺ.

What is Zakah?

Linguistically Zakah has multiple meanings, of them being Tahara (Purity) – in the sense of the purification of your wealth.

Allah makes mention in the Quran, Surah Tawbah, Verse 103:

خُذۡ مِنۡ أَمۡوَٰلِهِمۡ صَدَقَةً تُطَهِّرُهُمۡ وَتُزَكِّيهِم بِهَا وَصَلِّ عَلَيۡهِمْۖ إِنَّ صَلَوٰتَكَ سَكَنٌ لَّهُمْۗ وَٱللَّهُ سَمِيعٌ عَلِيمٌ

“Take, [O, Muhammed], from their wealth a charity by which you purify them and cause them increase, and invoke [ Allah ‘s blessings] upon them. Indeed, your invocations are reassurance for them. And Allah is Hearing and Knowing.”

Furthermore Zakah establishes subservience to Allah, it is an expression of gratitude for the blessing or wealth. It is also a purification of wealth and a means for one to multiply rewards in the hereafter.

Why Zakah?

Allah makes mention in the Quran, Surah Baqarah, Verse 110:

وَأَقِيمُواْ ٱلصَّلَوٰةَ وَءَاتُواْ ٱلزَّكَوٰةَۚ وَمَا تُقَدِّمُواْ لِأَنفُسِكُم مِّنۡ خَيۡرٍ تَجِدُوهُ عِندَ ٱللَّهِۗ إِنَّ ٱللَّهَ بِمَا تَعۡمَلُونَ بَصِيرٌ

“ And establish prayer and give zakah, and whatever good you put forward for yourselves – you will find it with Allah. Indeed, Allah of what you do, is Seeing “

We also find the famous Hadith in Sahih Al Bukhari, Hadith number 8. Ibn Umar (R.A) reports that the Prophet Muhammed ﷺ said:

“ بُنِيَ الإِسْلاَمُ عَلَى خَمْسٍ شَهَادَةِ أَنْ لاَ إِلَهَ إِلاَّ اللَّهُ وَأَنَّ مُحَمَّدًا رَسُولُ اللَّهِ، وَإِقَامِ الصَّلاَةِ، وَإِيتَاءِ الزَّكَاةِ، وَالْحَجِّ، وَصَوْمِ رَمَضَانَ ”.

“Islam is based on (the following) five (principles/pillars):

1. To testify that none has the right to be worshipped but Allah and Muhammed is Allah’s Messenger ﷺ.

2. To offer the (compulsory congregational) prayers dutifully and perfectly.

3. To pay Zakat (i.e. obligatory charity) .

4. To perform Hajj. (i.e. Pilgrimage to Mecca)

5. To observe fast during the month of Ramadan.”

The Function of Zakah:

- To alleviate poverty and the needs of the needy.

- Remove ill feelings and spiritual diseases such as jealousy and malice.

Conditions of Zakah

- A person must be a Muslim.

- The person must be mature and sane.

- One must be in the possession of the minimum Nisaab from things of a productive nature of which profit is derived.

Minimum Nisaab

- Minimum Nisaab on Gold is approx 87 grams.

- Minimum Nisaab on silver is approx 612 grams.

- As per the Islamic Economic indicators, the Nisaab value in Rands is R11 738.94 (as of 06 Ramadan 1446).

Once the minimum Nisaab has been reached (and very possible surpassed), it is necessary to pay 2.5% on your Zakatable wealth/assets that are in your possession after one full hawl (year).

Non-Zakatable Assets

There are assets which are you are not required to pay Zakah on and they include:

- Your home

- Vehicle

- Assets purchased for your own personal use, eg laptops and smartphones.

Zakatable Assets

These include:

- Gold

- Silver

- Cash (on hand, in a bank etc)

- Debts owed to you

- Investments

- Amwal al-Tijara : these are assets purchased with an intention to trade.

Recipients of Zakah

The recipients of Zakah are 8:

- A needy person – one who does not possess the Nisaab.

- A destitute and helpless person – one who does not own much besides few necessities.

- Those who work on administering Zakah.

- Those whose hearts have been recently reconciled (new Muslims).

- The one who is enslaved – to allow them to purchase their freedom.

- One who is in debt.

- The one who strives in the path of Allah – soldiers who strive in the physical path of Allah.

- The traveler (way-farer) – traveler who left his home for a lawful purpose and for whatever good reason does not possess enough money to return home, even if he is rich in his own country.

How do I discharge my Zakah?

One can directly approach a person who is eligible to receive Zakah or one can discharge their Zakah to a reputable organization that are frequently involved in the distribution of Zakah and who possess procedures to ensure a person is eligible to receive Zakah.

Zakat Treatment of Various Assets

- Shares: Zakah on shares depend on the intentions of the investor. There are 3 scenarios. Namely: Buy and Hold: Zakah is not due on the full market value and only on the proportion of net Zakatable assets in the company. Since it is difficult to deduce net Zakatable assets, a person can take 25% of the values of their shares and pay 2.5% of that value. Saving and Storing Wealth: Zakah is not due on the full market value and only on the proportion of net Zakatable assets in the company. One can apply the same treatment as the Buy and Hold scenario. Trading: Zakah is due on the full value of the investment at market value.

- Bonds: Bonds are not Shariah Compliant but if a person has bonds then Zakah is payable on the principle amount of the bond.

- Sukuk: This is often translated as “Islamic Bond”. According to AAOIFI standards there are atleast 14 different types of Sukuk. The Zakah treatment differs for each type

- Investment Land: If it is for personal use, store of value and investment then Zakah is not due on the land. If it is purchased with the intention of resell and trade then the Zakah is payable on value of the land.

- Investment Property: If the intention is to resell, Zakah is payable on market value. If the intention is for a long-term store value and with no intention to sell, Zakah is not due/payable. If it is investment property which is leased, Zakah is not due on the value of the asset however Zakah is due on any rental incomes.

- Unit Trusts: Zakah is due on the proportion of Zakatable assets. Each asset class needs to be taken into consideration.

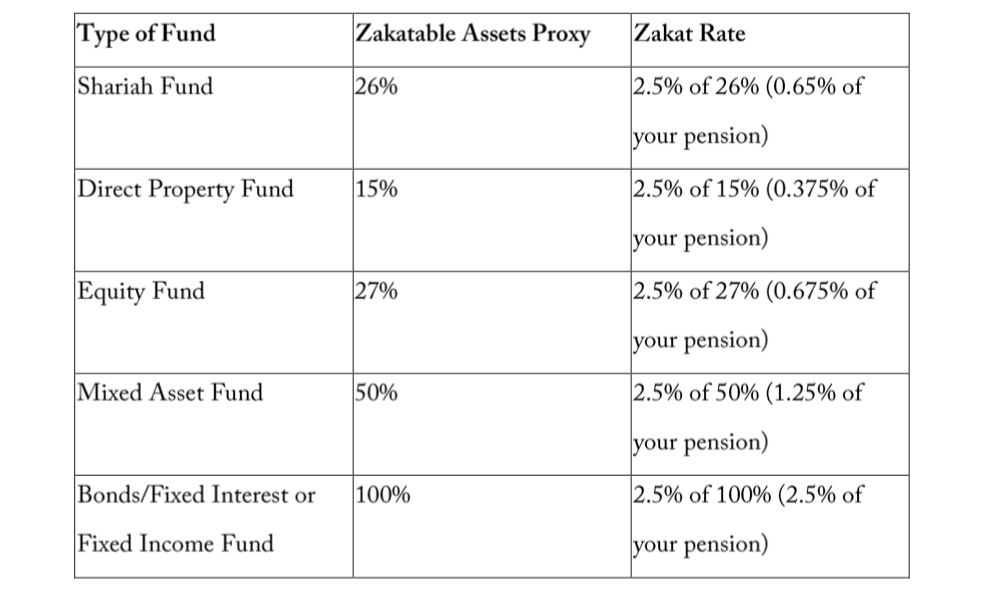

- Pension Funds: Ideally, Muslims are advised to review the fund fact sheet of the pension fund and should determine the percentage of zakatable assets. Once that is determine then one should add that value to their total zakatable assets and calculate 2.5% of the total value. If one is unable to do so, they may use the below proxys (as per Mufti Faraz Adam and the NZF).

How do I calculate how much Zakah to pay?

With the advancement of the internet and technology one can make use of a Zakah calculator found online. Organisations that have developed Zakah calculators include Jamiatul Ulama South Africa, Sanzaf, Ashraful Aid, Islamic Relief etc.

In conclusion, the above is a basic understanding of Zakah. For a more in-depth understanding of Zakah, one can contact a local Aalim.

Suggested reading : Zakat Made Easy by Mufti Faraz Adam. (If you wish to obtain a pdf copy, please email thegardenofknowledge786@gmail.com and we will send a pdf copy to you).

May Allah accept our efforts from us and grant us understanding In Sha Allah!

Leave a comment